In an attempt to ease economic pressure among seniors and pensioners, the Canadian authorities is anticipated to difficulty a $4,000 bonus beneath the Canada Pension Plan (CPP) and Old Age Security (OAS) packages this December 2024. With rising inflation and the excessive value of living, this bonus aims to provide timely financial comfort for eligible Canadians. But who qualifies? When will the payments be made? Let’s break it down.

What is the $4,000 CPP/OAS December Bonus?

The Canada Pension Plan (CPP) and Old Age Security (OAS) are crucial blessings for seniors, making sure economic aid during retirement. Recently, reviews of a $4,000 one-time bonus have surfaced, sparking each pleasure and confusion among recipients.

This bonus is intended to provide greater economic relief at some point of the vacation season. It comes as part of the government’s broader economic assist strategy to assist seniors in dealing with rising expenses, especially during the wintry weather months when expenses can be better because of heating and different necessities. However, it is important to word that not all people qualifies for this fee. Understanding the information of eligibility and a way to declare this benefit is vital.

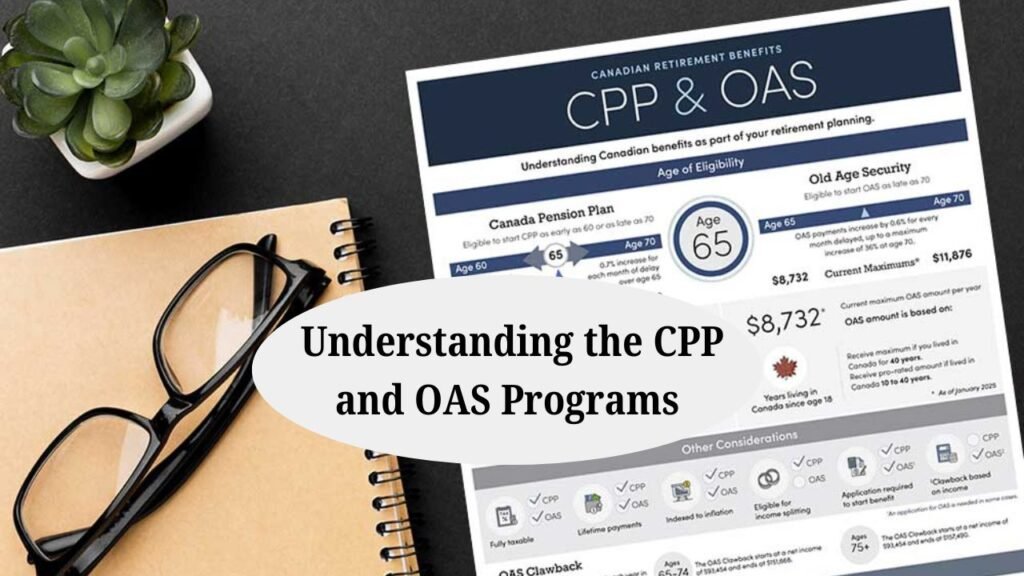

Understanding the CPP and OAS Programs

Before diving into the bonus, allow’s wreck down the two middle programs on the coronary heart of this discussion:

1. Canada Pension Plan (CPP)

- What It Is: CPP is a contributory plan for operating Canadians. You contribute to it at some point of your employment years, and upon retirement, you receive a monthly pension based to your contributions.

- Eligibility: You ought to have labored and contributed to CPP, commonly turning into eligible at age 60, with standard bills beginning at sixty five.

- Average Payment: As of 2024, the average monthly CPP fee is approximately $760, whilst the maximum can pass as much as $1,300.

2. Old Age Security (OAS)

- What It Is: OAS is a non-contributory benefit funded via preferred tax revenues. It gives economic help to seniors elderly 65 and older who meet residency requirements.

- Eligibility: You should have lived in Canada for at least 10 years after turning 18 to qualify for partial payments and forty years for the entire pension.

- Average Payment: The common OAS charge in 2024 is around $700 monthly, with additional supplements just like the Guaranteed Income Supplement (GIS) to be had for decrease-income seniors.

Eligibility for the $4,000 December Bonus

The $4,000 bonus is not mechanically furnished to all CPP and OAS recipients. Here’s what you need to know:

Key Eligibility Criteria:

- Age Requirement: Must be sixty five years or older (or receiving early CPP advantages).

- Residency: You ought to currently are living in Canada and meet CPP/OAS residency policies.

- Income Threshold: Lower-profits people may be prioritized for the whole bonus amount.

- Program Participation: Active participation or qualification for either CPP or OAS is obligatory.

Income-Based Prioritization:

- Seniors with annual incomes below $30,000 may additionally qualify for the entire $4,000 bonus.

- Seniors incomes above $50,000 yearly may additionally receive a reduced quantity or no bonus in any respect.

How to Verify Your Eligibility:

- Log into your My Service Canada Account (hyperlink here) to check your CPP and OAS fame.

- Contact Service Canada directly at 1-800-277-9914 for customized assistance.

Payment Dates for CPP/OAS in December 2024

For recipients of CPP and OAS, month-to-month payments are scheduled ahead of the vacation season. This guarantees seniors can manipulate expenses, especially at some stage in December’s busy duration.

December Payment Dates:

- Canada Pension Plan (CPP): December 20, 2024

- Old Age Security (OAS): December 20, 2024

If bills are not on time, seniors are recommended to contact Service Canada or test their financial institution money owed and mail for updates. Mark your calendar and display your bank account for these payments.

How to Claim $4,000 CPP/OAS December Bonus

If you meet the eligibility standards, right here are the stairs to claim the $4,000 CPP/OAS December bonus:

Step 1: Verify Your Eligibility

- Visit your My Service Canada Account to make certain you qualify.

- Check for notifications or communications from Service Canada.

Step 2: Submit Your Claim (If Required)

If a guide software is needed, down load the essential forms from the Government of Canada internet site.

- Provide supporting documents together with:

- Proof of age (e.g., birth certificates).

- Residency details (e.g, software payments, tax forms).

- Proof of earnings (e.g, Notice of Assessment).

Step 3: Monitor Your

- Payments Payments will be deposited at once into your bank account or mailed thru cheque, depending for your setup with Service Canada.

Step 4: Watch Out for Scams

- Be cautious of fraudulent emails, texts, or calls claiming to provide bonuses. Verify all communications at once with Service Canada.

Step 5: Follow Up

- If you do not obtain the bonus through December 31, 2024, touch Service Canada promptly for help.

Additional Benefits for Seniors

Apart from the CPP/OAS bonus, seniors can explore other economic benefits to maximise their retirement profits:

- Guaranteed Income Supplement (GIS): A month-to-month, non-taxable advantage for low-income OAS recipients and Eligibility depends to your annual earnings.

- Allowance and Allowance for Survivor: Financial assistance for people elderly 60-sixty four who’ve low earning or are widowed.

- Provincial and Territorial Benefits: Many provinces offer supplementary advantages for seniors. Visit your provincial website for information.

- Winter Heating Assistance Programs: Seniors can apply for energy value help through provincial packages all through the iciness months.

Final Thought

The $4,000 CPP/OAS December Bonus is a welcome initiative to help Canada’s retirees manage increasing costs and economic challenges. If you’re a senior citizen receiving CPP or OAS, check your eligibility and prepare for a potential payout this December. Staying informed and keeping your Service Canada account updated is key to ensuring you receive this benefit.

FAQ’s

Is the $4,000 December Bonus Taxable?

No authentic confirmation exists concerning taxation, however most government benefits are taxable except otherwise certain.

Can I Receive Both CPP and OAS?

Yes

When Will the Bonus Be Paid?

If eligible, assume the charge through December 20, 2024, along your everyday CPP or OAS bills.